Understanding and promoting alternative giving methods open up myriad pathways for nonprofits to amplify fundraising efforts substantially. In the current philanthropic climate, where donor preferences and financial environments are ever-changing, it’s crucial for organizations to adapt and adopt a more diversified approach to soliciting support.

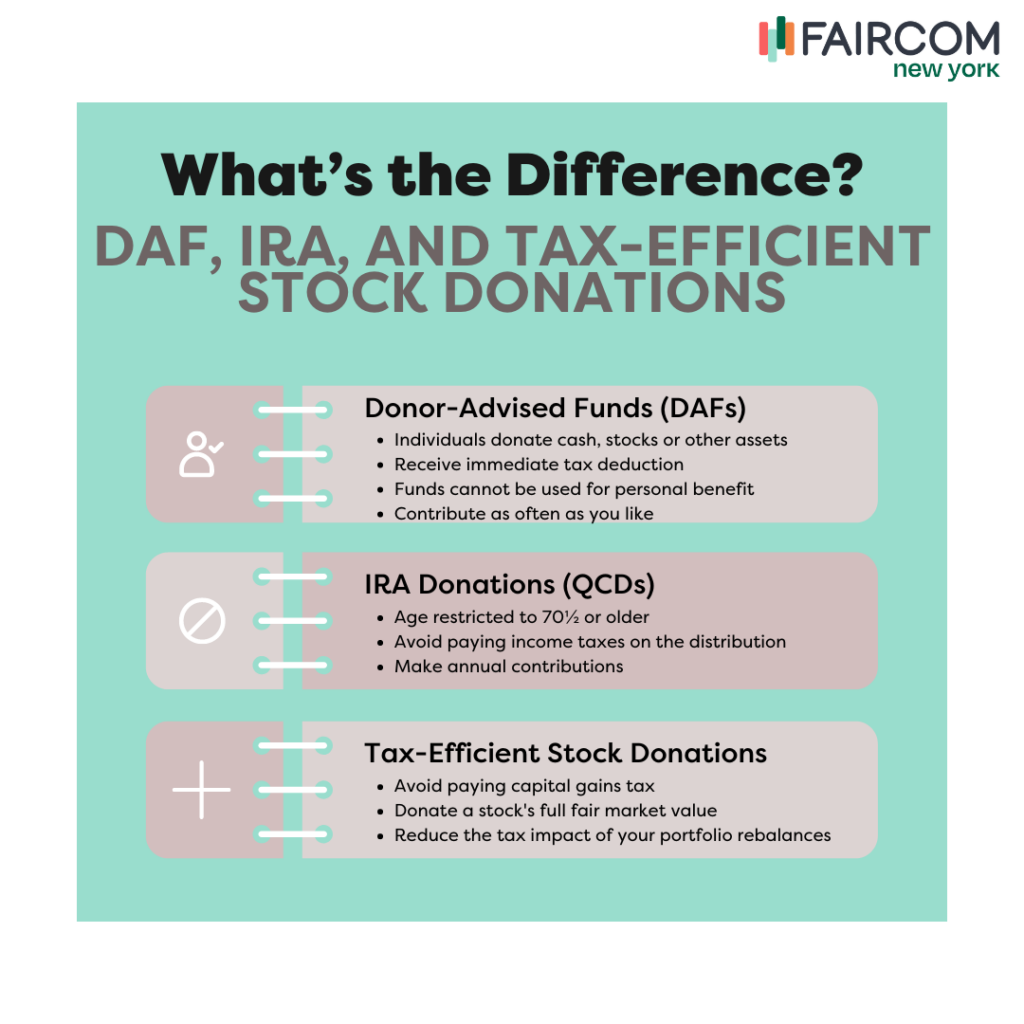

Alternative giving encompasses a wide range of options, from DAFs and IRAs to cryptocurrency donations and beneficiary designations, offering donors the flexibility to choose how they can contribute as well as tax benefits and financial advantages. By effectively communicating the value and impact of these giving methods, nonprofits can attract a broader spectrum of contributors. More importantly, these alternative avenues can facilitate larger donations, as they enable donors to leverage their assets in the most financially advantageous ways — while also helping organizations identify high-value prospects who may have increased capacity to give.

For nonprofits, diversifying funding streams through alternative giving methods is not just about increasing the volume of donations but also about building a robust financial foundation that can weather fluctuating economic trends and donor preferences. Moreover, educating donors about the benefits and processes involved in alternative giving can enhance the donor experience, fostering long-term relationships and a strong sense of loyalty to the organization.

By embracing a comprehensive strategy that includes clear communication, easy-to-use donation tools, and personalized acknowledgment of each gift, nonprofits can significantly bolster their fundraising efforts and advance their missions with increased financial security and donor engagement:

1. Maximize Donor-Advised Fund Visibility:

Donor-advised funds (DAFs– charitable giving accounts) are a rapidly growing option for many people. By making it easy for donors to contribute through DAFs, including providing clear instructions and your tax ID on your website, you can tap into a larger portion of a donor’s charitable giving. Targeted campaigns aimed at DAF donors can also highlight the ease and mutual benefits of this giving avenue. This approach can increase your organization’s portion of a donor’s philanthropic budget and uncover potential candidates for more substantial contributions.

2. Leverage Individual Retirement Accounts (IRA) Qualified Charitable Distributions (QCDs):

Older donors can make tax-free gifts directly from their IRAs to your organization, which can be especially appealing since these gifts can satisfy required minimum distributions without increasing taxable income. The opportunity for older donors to make tax-free charitable gifts directly from their IRAs represents a highly beneficial and often underutilized giving avenue for both the donors and nonprofit organizations.

For nonprofits looking to tap into this potential revenue stream, a multi-faceted outreach and education campaign can be instrumental. Direct mail remains a powerful channel through which to engage this audience, offering a tangible reminder of how their support can make a difference through a method that may be financially advantageous to them. Complementing this, dedicated landing pages on the organization’s website can serve as a rich resource, guiding interested donors through the process step by step.

3. Promote Tax-Efficient Stock and Cryptocurrency Donations:

Highlighting the tax advantages of donating appreciated assets, such as stocks, bonds, or real estate, to prospective donors can significantly enhance your nonprofit organization’s fundraising strategy. Many potential donors are not aware that by contributing these types of assets directly to a charity, instead of selling them first and then donating the proceeds, they can avoid paying capital gains tax on the increase in value of the asset. This not only allows the donor to potentially deduct the full market value of the asset on their tax returns but also increases the overall value of their contribution to the nonprofit. Such tax-efficient giving methods can be particularly attractive to donors who are looking for ways to maximize the impact of their philanthropy while minimizing their tax liability.

To effectively promote the benefits of donating appreciated assets and simplify the process for donors, nonprofits should prioritize clear online guidance and regular communication. This can include creating dedicated sections on their website that identify which assets they will accept, clearly outline the steps to donate stocks, real estate, or other assets, complete with downloadable forms, contact information for further assistance, and frequently asked questions. Interactive tools, such as calculators that show the potential tax savings and impact of such gifts, can also help demystify the process for donors. Beyond the website, regular communication through newsletters, email campaigns, and targeted outreach can raise awareness among the donor community.

4. Foster a Culture of Legacy Giving:

Legacy gifts, such as bequests made through a will or living trust, are indispensable for your nonprofit’s future financial resilience. To foster these kinds of contributions, it is crucial to engage in continuous education with your supporters, illuminating the process and benefits of including charitable gifts in estate plans.

This can be achieved through sharing impactful stories of how legacy gifts have influenced the organization and providing clear, accessible resources. Leveraging significant occasions, such as National Make a Will Month, offers an excellent opportunity to amplify these efforts by encouraging supporters to consider their long-term philanthropic legacies.

By undertaking these strategic efforts, nonprofits not only secure their financial future but also enable donors to achieve their desire to leave a meaningful legacy that reflects their values and supports the causes important to them. This twofold approach helps organizations maximize the potential of legacy giving, ensuring long-term stability and impact.

5. Unlock the Potential of Employer Matching Gifts:

One often overlooked but highly impactful avenue for increasing fundraising is through employer matching gift programs, where a company matches the charitable donations made by its employees, effectively doubling the contribution to the nonprofit. Many donors are unaware that their employers offer such programs, potentially leaving substantial sums of money unclaimed, money that could make a significant difference to their chosen charities.

Nonprofits have an important role in educating supporters about this opportunity. By promoting this possibility through newsletters, social media campaigns, and during donation processes, organizations can encourage donors to take advantage of their employer’s matching gift programs leading to a substantial boost in funding.

6. Harness the Power of Peer-to-Peer Fundraising:

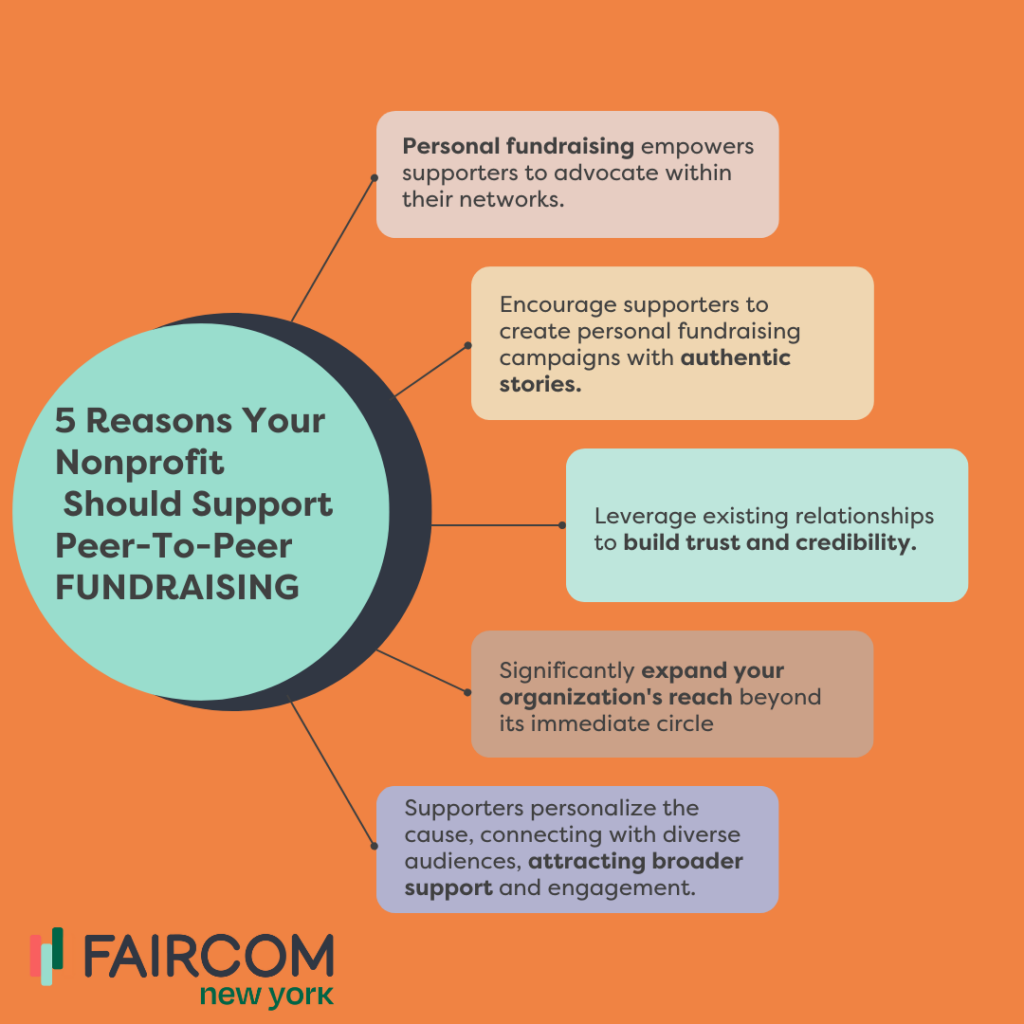

Personal fundraising pages empower supporters to take an active role in your nonprofit’s mission by becoming advocates within their own networks. Encourage supporters to strike out on their own and create individual fundraising campaigns. These can include personal stories and reasons for backing the cause, making their appeals more authentic and compelling to family, friends, and colleagues.

This person-to-person approach leverages existing relationships to build trust and credibility, significantly expanding your organization’s reach beyond its immediate circle. Furthermore, when supporters become fundraisers, they help to personalize the cause, connecting it with diverse audiences and adding unique perspectives that might resonate with different groups, potentially attracting more widespread support and engagement.

Pro Tip: incentive top fundraisers. By initiating challenges and providing rewards such as exclusive merchandise, special recognition at events, or a feature in organizational communications, nonprofits can motivate participants to raise more funds.

7. Open the Door to Beneficiary Designations:

Encouraging donors to name your organization as a beneficiary on their retirement accounts, life insurance policies, or annuities is a strategy that can secure substantial future support for your nonprofit. This method of giving is appealing because it is relatively simple for donors to set up and doesn’t impact their current finances; they can continue to enjoy their assets during their lifetime while aligning their philanthropic legacy with their values.

This strategy is notably beneficial as it gives donors the flexibility to control the portion of their assets they wish to donate, while potentially providing for others and enjoying tax benefits. Assets directed to a nonprofit may avoid certain taxes, benefiting the donor’s estate. This not only promises future funding for the organization but also deepens its relationship with supporters, ensuring their contributions have a lasting impact on the causes they care about.

8. Implement a Robust, Targeted Gifts-in-Kind Program:

Clear communication about what items or services your nonprofit requires steers potential donors towards in-kind gifts that fulfill genuine gaps. This targeted approach ensures that the support received is both relevant and beneficial, avoiding the unnecessary accumulation of unusable items. Maintain transparency about current needs through newsletters, social media updates, or wish lists on your website to encourage supporters to make in-kind donations that have a tangible and meaningful impact.

To maximize the effectiveness of in-kind giving, having structured drives and a well-organized system for acknowledging these donations. Timely acknowledgment, whether through personalized thank-you messages, public appreciation on various platforms, or providing donors with a receipt for tax deduction purposes, helps in building a positive donor experience.

9. Leverage Fundraising Apps to Engage Younger Donors:

Incorporating digital platforms that resonate with younger generations is vital for modern nonprofits seeking to engage a broader and more technologically savvy donor base. Today’s younger donors are drawn to interactive and seamless giving experiences that fit into their digital-first lifestyle. By integrating gamification elements into fundraising efforts, nonprofits can transform the act of giving into a more engaging and enjoyable activity.

Leveraging apps, alongside the absolute necessity of mobile optimization in your online fundraising across the board, can help forge stronger connections with younger generations. By creating an inviting, accessible environment for them to engage, you make it easier for them to support causes they care about in natural and intuitive ways.

10. Optimize Your Website for Alternative Giving:

Your organization’s website needs to facilitate a variety of giving options in order to attract a diverse range of donors. An effective website should clearly outline each available method of giving, whether it’s one-time or recurring donations, gifts of stocks and securities, legacy giving, in-kind contributions, or fundraising events.

Detailed explanations and FAQs that address common concerns or questions can help demystify the giving process, enabling donors to understand the benefits and logistics of each method.

Additionally, offering direct contact options for assistance can greatly enhance donor confidence and satisfaction. It’s crucial for donors to know they can easily reach out for personalized support if they need more information or encounter any issues.

11. Recognize Donors for Their Full Impact:

Acknowledging all contributions, regardless of how they are made, plays a crucial role in fostering a culture of appreciation and engagement. Contributions made through indirect means, such as employer matching programs or donor-advised funds should be recognized as equally important and highlight the collective effort involved in supporting a cause.

When donors see that the organization appreciates not just the amount, but the collaborative aspect of their giving—leveraging additional funds through their employers or financial planning tools—they feel more valued and part of a larger community of supporters. This sense of belonging and mutual goal achievement encourages a deeper connection with the organization, making donors more likely to continue their support and even increase their involvement over time.

People Like Options. Are You Maximizing Yours?

Implementing diverse and flexible fundraising strategies is a powerful way for charities to broaden their donor base and provide supporters with various tax-efficient options to contribute to their favorite causes. By offering multiple avenues for donation, such as stock gifts, bequests, donor-advised funds, and employer matching programs, charities cater to the varying financial preferences and situations of potential donors. This inclusiveness not only makes it easier for individuals to engage in philanthropy but also maximizes the tax benefits available to them, thereby enhancing the appeal of donating. Moreover, when supporters understand that they can make a difference in a way that aligns with their personal financial planning, they may be more likely to give—and give more generously. Embracing such flexibility ensures that donors can choose the methods of giving that resonate most with their lifestyles, further solidifying their connection to the cause.

Expanding the scope of alternative giving methods also has a profound impact on the strength and durability of the bond between supporters and the missions they care about. By acknowledging and accommodating different ways to support a charity, organizations send a clear message: every contribution, regardless of size or form, is valuable and appreciated. This recognition can significantly deepen the sense of commitment and partnership that donors feel towards the charity, leading to a more engaged community of supporters. In turn, this can foster long-term, sustainable relationships that not only ensure steady support for the organization but also amplify its impact. Charities that prioritize understanding and facilitating the diverse preferences of their donor base set the stage for continuous engagement and a long-lasting, impactful relationship that benefits both the charity and its supporters.