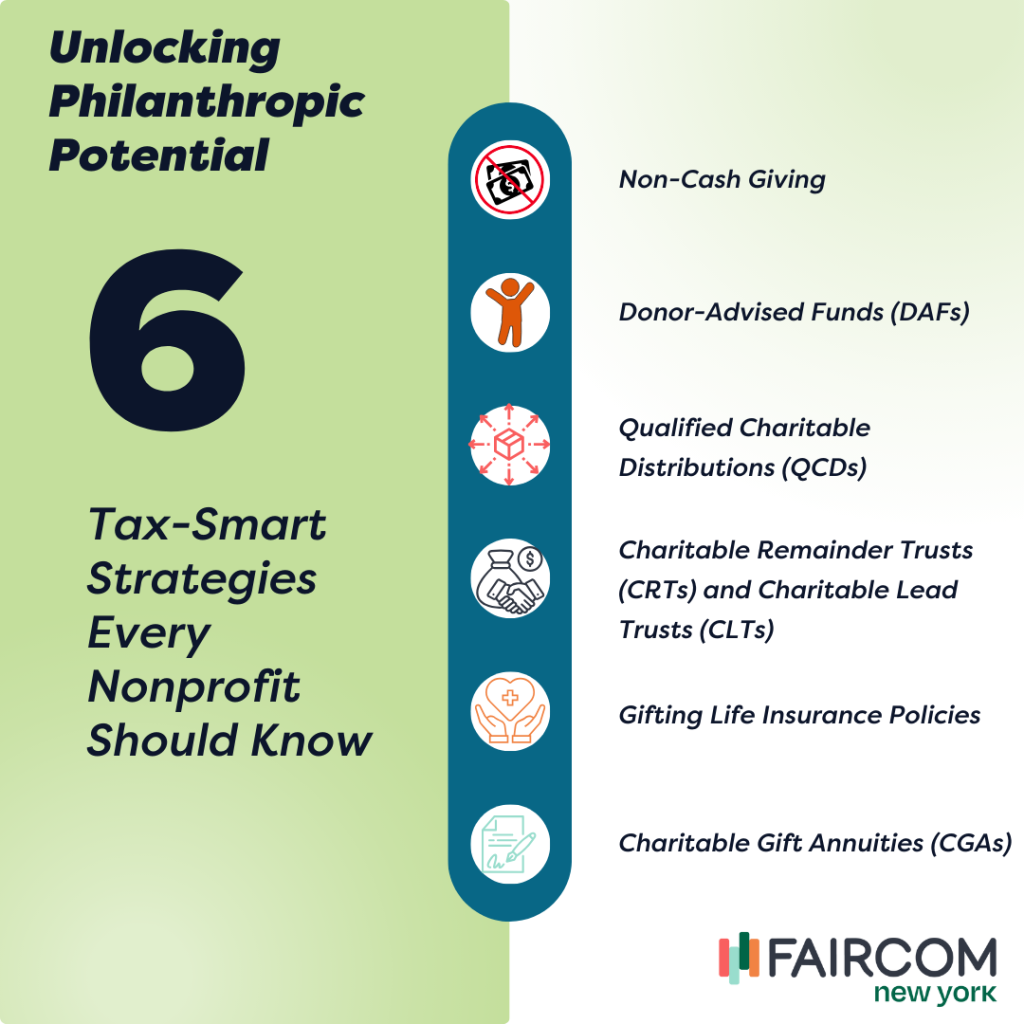

Tax-smart philanthropy isn’t just about efficiency – it’s about enhancing your relationships with donors and amplifying the impact of their generosity. Let’s explore several strategies that exemplify how thoughtful, tax-friendly planning can align your nonprofit’s goals with donors’ financial and philanthropic aspirations to elevate donor engagement and outcomes.

Non-Cash Giving: A Win-Win for Donors and Nonprofits

Non-cash giving opens the door to untapped opportunities for both donors and nonprofits by reaching beyond traditional cash donations. While 90-95% of individual net worth in the U.S. is held in non-cash assets, fundraising has predominantly targeted the 5-10% in cash. Encouraging gifts of appreciated assets, such as stocks, real estate, or art, can offer donors considerable tax benefits by avoiding capital gains taxes while providing your nonprofit with valuable resources.

Additionally, non-cash giving options don’t compete with essential cash needs like housing, groceries, or other daily expenses. This distinction often makes it easier for donors to contribute larger amounts than they might otherwise consider, maximizing the impact of their generosity. Educating your supporters on the advantages of non-cash giving can spark deeper engagement and higher levels of support.

Donor-Advised Funds (DAFs): Flexible Philanthropy

DAFs have surged in popularity, serving as philanthropic savings accounts from which donors can recommend grants to their favorite charities over time. For nonprofits, forming strong relationships with DAF donors and understanding their interests and intentions can lead to substantial support. The flexibility DAFs offer appeals to donors looking for an immediate tax deduction while planning their charitable giving.

Educating donors about DAFs and their benefits also positions your nonprofit as a trusted partner in philanthropy. By providing resources, tools, and guidance, you can help donors tap into the full potential of DAFs and demonstrate how these funds can align with their values and create meaningful impact. This proactive approach not only builds trust but also deepens engagement, making your nonprofit an indispensable collaborator in the donor’s journey to achieve their philanthropic goals.

Here are five tips for maximizing DAF donations.

Qualified Charitable Distributions (QCDs): Tapping into Retirement Funds

QCDs allow individuals over 70½ years old to donate directly from their Individual Retirement Accounts (IRAs) to a charity, tax-free, up to $100,000 per year. This can satisfy their Required Minimum Distributions (RMDs) without increasing their taxable income. Making your donors aware of this option can not only provide your nonprofit with immediate funding but also contribute to your donors’ financial well-being.

Nonprofits can amplify the impact of QCDs by tailoring outreach to older donors, particularly those who may not be aware of this opportunity. Highlighting the dual benefit of supporting a cause and reducing taxable income can resonate strongly. Personalized communication and resources – for example, guides or webinars explaining how QCDs work – can empower donors to see this option as a seamless way to align their financial planning with their philanthropic goals.

Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs): Trust-Based Giving

CRTs and CLTs are sophisticated philanthropic tools that enable donors to make a lasting impact while addressing their financial and estate planning needs. A CRT provides donors or their beneficiaries with income for life or a set term, with the remainder eventually supporting your nonprofit. In contrast, a CLT allows the nonprofit to receive an income stream for a set period, with the remaining assets going to the donor’s beneficiaries. These trusts can offer compelling tax advantages and estate planning benefits, making them an attractive option for donors with complex financial portfolios.

By helping donors understand these options, nonprofits can position themselves as partners in legacy planning. Educational resources, such as case studies or consultations with planned giving experts, can illustrate how these trusts deliver significant tax advantages while aligning with a donor’s broader financial goals. This guidance fosters trust and encourages donors with complex financial landscapes to consider your organization as part of their long-term philanthropic vision.

Gifting Life Insurance Policies: Uncovering Hidden Potential

Life insurance policies, a non-traditional asset class, are an often overlooked but potentially powerful philanthropic tool. Encouraging supporters to name your organization as a beneficiary or transferring ownership of the policy can result in sizable donations. This strategy requires minimal outlay from donors while promising significant long-term benefits for your nonprofit.

Nonprofits can inspire donors to explore this option by sharing stories of how legacy gifts have created meaningful impact. Providing step-by-step guidance on how to designate a beneficiary or transfer a policy can demystify the process. Engaging financial advisors in donor outreach efforts can also help uncover opportunities where life insurance policies align with a donor’s broader estate and giving plans.

Charitable Gift Annuities (CGAs): Guaranteeing Support While Providing Stability

CGAs allow donors to make a meaningful gift while ensuring financial stability. In exchange for their donation, donors receive fixed, regular payments for life, creating a reliable income stream. Upon the donor’s passing, the remainder supports your organization. This strategy can appeal to donors who wish to make a meaningful gift while ensuring their financial security.

To maximize interest in CGAs, nonprofits can emphasize their dual benefits: financial security for the donor and significant support for the organization. Consider offering personalized projections showing potential payment rates and long-term impact. Highlighting CGAs as part of broader retirement and estate planning conversations can appeal to donors seeking both stability and legacy.

Building Relationships Through Strategic Giving

As nonprofit leaders and fundraisers, embracing these tax-smart strategies not only diversifies your organization’s funding sources but also deepens your engagement with donors. By educating your supporters on these options and implementing specifically targeted campaigns to attract the right donors to these options, you demonstrate a proactive and strategic approach to philanthropy that respects financial goals and philanthropic values.

The Path Forward

Incorporating these tax-smart giving strategies into your fundraising efforts requires patience, diligence, and a commitment to building strong, trust-based relationships with your supporters. It’s about more than just securing resources for your organization; you will be creating a community of informed, engaged donors who share your commitment to effecting positive change.

Navigating the options available in tax-smart philanthropy can seem daunting. However, by breaking down these strategies and understanding how they align with your donors’ needs and aspirations, you can unlock new potential in fundraising. Remember, at the core of these efforts lies a shared vision—a wish to make a difference in the world. Through strategic planning, empathy, and collaboration, we can maximize the impact of philanthropy, reinforcing the foundation upon which our communities thrive.

By championing tax-smart giving, your nonprofit galvanizes its financial stability while amplifying the collective impact of its supporters, moving confidently into a future where the generosity of today seeds the transformations of tomorrow.